Taxpayers meeting the minimum income threshold are required to file a tax return each year. The tax return documents their income and any valid exempt

Taxpayers meeting the minimum income threshold are required to file a tax return each year. The tax return documents their income and any valid exemptions. For example, taxpayers can reduce the income tax they have to pay by claiming dependents, medical expenses, and property taxes.

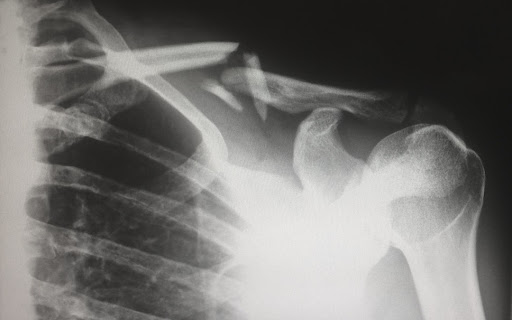

Millions of taxpayers suffer personal injuries each year. Each year over four million people in the United States require medical care following car accidents. In addition to auto accidents, millions more sustain workplace, sports, and recreational injuries annually. Injuries from accidents can lead to loss of income, which is one way being in an accident could affect your taxes. There are multiple factors related to your accident that could impact your taxes. Read on to learn about some of the ways being in an accident could affect your tax return.

Your taxes could be affected by the loss of income.

Your income tax filing involves reporting your taxable income for the tax year. Employees fill out a W-4 form. Employers use this form to withhold income tax from the employees’ salaries. Employers complete a W-2, reporting how much money each employee earned and had deducted from their salary for taxes. Once you have your taxes, you can use an online tax program to file your taxes or hire a tax accountant to complete your tax forms. You can also claim valid deductions.

Suppose you’re unable to work for some time following an accident. Your income will decrease. Since your tax withholding amount is based on your expected annual salary, the amount of taxes you owe will decrease. Depending on how much your income decreased and whether you used alternate income sources, you may be eligible for a refund.

Your taxes could be affected if you tap into your savings.

Suppose you use Acorns TurboTax to save funds. If you have the Acorns Personal account, you can set money aside in a SEP IRA retirement account. Funds put into an approved retirement account, such as an SEP IRA, are considered tax-deferred. Using the Acorns app to build your savings reduces your immediate tax burden because you won’t pay taxes on money placed in a retirement fund until you withdraw those funds. However, suppose you’re injured in an accident and unable to work. In that case, you may opt to withdraw money from your retirement account to cover personal expenses, which will impact your tax return.

Your taxes could be affected by financial settlements.

It’s a good idea to talk to an experienced personal injury lawyer if you’ve been injured in an accident. When you contact a Denver personal injury attorney, you’ll receive a free consultation. This means you can discuss your accident with a personal injury attorney to determine if you have a solid legal case and should pursue a personal injury claim.

Your lawyer can file a lawsuit against the at-fault party and negotiate settlements with insurance companies and the negligent parties involved. You may receive financial compensation for physical injuries, medical bills, pain and suffering, and loss of income. Your attorney’s objective is to ensure you receive a fair settlement following your accident.

Money received from a financial settlement may or may not be taxable. You may be required to claim money received for punitive damages, while you may not need to claim funds received for your physical injuries.

Your taxes could be affected by medical expenses.

You can claim medical costs when you file your tax return. Deductions from medical bills related to your personal injury case will reduce the amount of income tax you owe. Medical expense deductions can be complex, and you may need to hire a tax accountant to ensure you maximize your deductions.

Being in an accident could affect your taxes in multiple ways. You may experience a loss of income due to your injuries and have medical expenses you can claim as deductions, which will affect how much income tax you owe. You may need to use retirement savings to cover your expenses until you receive benefits or a financial settlement, which will affect your taxes. Your taxes can also be affected by financial settlements from a lawsuit, depending on why you received the settlement funds.

Join the legal haute couture on our Legal Blog! Write for us law, and let your prowess as a top immigration lawyer in the USA shine, making waves in the legal fashion scene