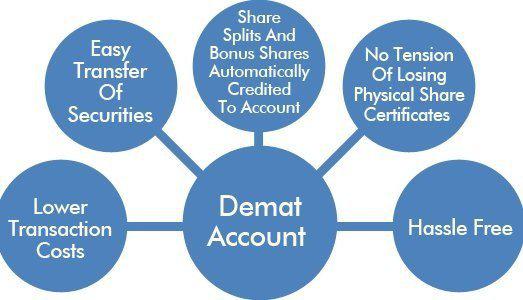

The demat account is where you maintain your electronic shares. With the introduction of demat, the erstwhile physical certificates have become largely redundant. You essentially maintain shares in the form of electronic records and your shares with one of the depositories; NSDL or CDSL. But demat account is not something you can operate in a very impersonal fashion. After all, it is your long term equity investments that you are going to hold in your demat account. You need a clear 5-point strategy to make the best of your demat account. Here is how…

- Review the charges before opening a demat account

Be sure to review all aspects of the competitive landscape before opening your demat account. It is better you open your demat account with your broker as that makes the entire process much simpler. The big challenge of keeping your broker and DP separate is that the onus is on you to ensure that the debit instruction slip (DIS) in the event of sale of shares is delivered to the broker on time. If the demat account and the trading account are with at the same place, it solves a lot of hassles for you. It is important to review the costs. Costs of demat is not just about getting a free account opening. It is about the annual maintenance charge (AMC), debit costs for selling shares, other charges etc. If you are small investor with value of shares less than Rs.2 lakh then opt for the BSDA account which will be a lot more economical.

- Keep an audit trail of all transactions

This is where most investors falter. Every transaction has an audit trail. For example, when you buy shares your bank account gets debited, the trading account executes the transaction and the credit into demat account comes on T+2 day. Similarly, when you sell the shares, your demat account gets debited on T+1 day, the trading account gets executed and the bank account gets credited by the end of T+2 day. For every transaction, check the complete audit trail which covers your bank account and your DP account. Also ensure that you have clear delivery of shares in your demat account before you sell the shares. You can either check that online or you can call up your DP and check the status.

- Give security top priority when operating your demat account

Remember, your demat account is your long term wealth and you cannot afford to be lax with security issues. Some basic issues have to be ironed out. Don’t leave your DIS booklet unattended. Keep it in a safe and secure place. Always insist that your DP must issue a DIS booklet with your client code stamped on the DIS. After you mention the number of shares in words and the ISIN, if there is any blank space then just cancel it out to avoid misuse. If you are using online DP, there are some more precautions you need to take. Keep a double authentication for your DP access and don’t share your password with anyone. Always make it a point to access the DP account online by yourself and from your own computer using a secured internet connection. Accessing your demat account on free Wi-Fi facilities in airports, shopping malls is a strict “No”.

- Get regular statements and cross verify

You can download statements online and that is why registering online is important. Take a print of your demat statement each month and reconcile with your trading account ledger. This can overcome most of the problems that we come across. If you seen any discrepancy bring it to the notice of your DP immediately to get it resolved. There are cases like auctions where y our delivery could get delayed, but you need to get clarity from your DP. Also keep a tab on your opening stock and your closing stock as it is important for your tax filing purposes.

- Keep a tab on corporate actions

Corporate actions are of two types; cash and non-cash. Since you can hold equities and bonds in your demat account, you will get cash payouts in the form of interest and dividends. These will get directly credited to your bank account and you need to do bank reconciliation for the same. Then there are non-cash corporate actions like bonuses and stock splits which are automatically credited to your demat account. The onus is on you to check these things constantly and keep a check list of corporate actions. If you find any discrepancy in this regard, you will have to directly contact the Registrar and Transfer Agent (RTA) to get the same resolved.

It is not just about opening your demat account. There are some basic steps and strategies required to make your demat account a lot more effective.