A VAT registered contractor or VAT accountant is responsible for calculating the VAT return every quarter or annually, which is needed to be submitted to HMRC. The VAT return is calculated by adding up the VAT a business has charged on sales and then deducting the VAT amount which they have used on business expenses. Input tax and output tax are important terms while calculating VAT return. You can calculate this by yourself or find an Local accountant for doing the work for you.

What do you mean by Output Tax?

If you are a businessman, VAT is the value added tax you are charging on every good you are selling or services you are providing to customers or to any other business. If you have registered your business for VAT, you are bound to charge VAT on every item it can be charged on and mention that in each of the sales invoices. The standard rate of VAT is 20%.

VAT which is charged on sales to businesses must be recorded in a separate sales document for goods and services provided to other businesses. The things which should be taken in account are invoices, bills, receipts which are issued by seller along with contract notes and settlement notes.

What do you mean by Input Tax?

When you are purchasing goods or services for your business, you are required to pay value added tax on the goods which are liable to VAT. The amount you are paying is called Input Tax and it only can be recorded for business expenses.

How to submit your VAT return to HMRC?

Calculating VAT return is really easy. You are just required to add the Output Taxes and deduct from that the Input Taxes. If you find out that by mistake you have paid more VAT amount than you have received, you can easily claim for the repayment while your VAT return. Similarly, if somehow you have taken in more VAT than you have paid, you are required to balance the difference.

Nowadays VAT returns can only be submitted to HMRC through online. It has become really simple, easy and quick unlike the old days when VAT returns were a struggle.

How much is VAT?

There can be three different rates of VAT. One is standard rate which is 20%, other is reduced rate which is 5%, another is zero rate which is 0%. Most of the items are sold at standard rates, if nothing is mentioned specifically. The reduced rate is eligible for necessary items like domestic fuel and power, while installing energy-saving materials, the products for sanitary hygiene and for children’s car seat. The zero rate VAT applies to the basic items like food, newspaper and books, clothes and shoes for children and public transport. There are certain things which are not eligible for VAT like insurance, education, several fund-raising events for charity, etc.

Making Tax Digital

HMRC has decided to incorporate Making Tax Digital (MTD) especially for businesses which have registered themselves for VAT. Making Tax Digital has been introduced to make the tax returns easier and seamless. It is designed in such a way that quarterly updates will be sent directly from your accounting software to HMRC. If you are someone who is still using spreadsheets and papers to figure out VAT returns, you need to modify the way you are doing things.

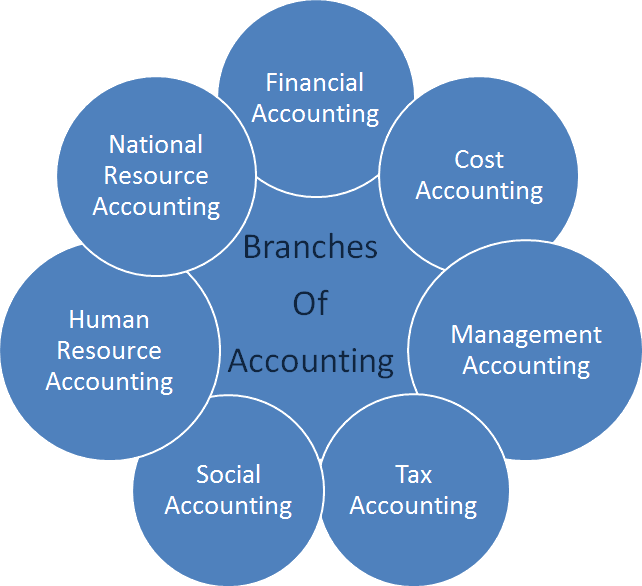

Check here What are the different branches or types of accounting?